Dear Friends, Colleagues & Customers:

Last week MBA sent an interesting letter to several federal regulatory agencies including CFPB to clarify how existing fair lending and the Equal Credit Opportunity Act adverse action notification requirements apply to Artificial Intelligence technologies. Now this is really a big deal.

Quoting from the letter - "“AI has particular potential in the area of credit underwriting where it can it be combined with alternative or non-traditional data to expand access to affordable (and sustainable) mortgage credit. Despite these benefits, broad adoption of AI has been slowed by uncertainty surrounding how AI fits within a regulatory framework that was largely created before its development."

Traditionally, underwriting rules considered just three factors: income, assets and credit score. MBA's letter is making a case that the time has come to consider other factors / social signals. New age lenders that are into Small Business lending are already do this. And giving a mortgage loan to a small business loan is not very different from small business lending itself. But the worry is, lenders who consider these factors will get caught in regulation. I think MBA's move deserves all our support.

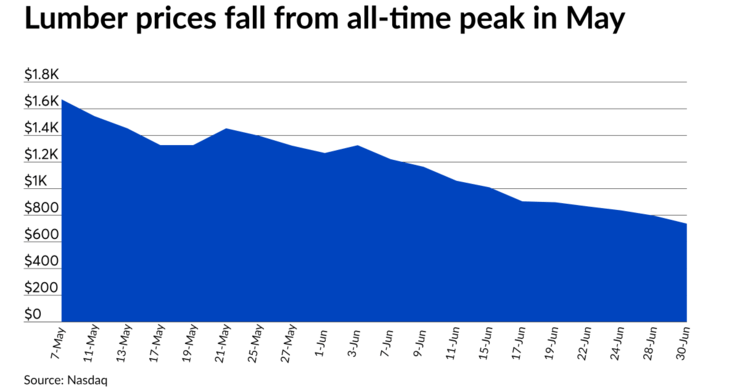

We discussed how the sky rocketing prices of lumber are putting pressure on builders and buyers alike. Finally these seems to be some respite. Lumber futures ended June with a closing price of $737.40 per thousand board feet after starting the month at $1,267.50 and spiking to an all-time high of $1,670.50 on May 7, according to data from Nasdaq. While still above the year-ago rate of $431.60, it reached the lowest point since $700 on Jan. 20. The recent fall represents drops of 55.9% from May’s peak and 41.8% throughout the month.

Mortgage rates have fallen below 1%. Before you get too excited, let me add that is in the UK. But just a thought, what would happen if the same happens here in the US?

It turns out that, low interest rates are not enough to lure refi borrowers. According to a recent Zillow survey, fewer than a quarter of established homeowners refinanced their mortgages over the last year, even though about half of those who did say they cut their monthly payments by at least $300. Homeowners who have recently refinanced ranked the process as less difficult than getting a divorce or following a strict new diet, but significantly tougher than training a puppy. Go figure!

MBA Chief Economist, Michael Fratantoni wrote in International Banker last year that, the cost of servicing loans has grown as much as three times since the last financial crisis, while the cost of servicing non-performing loans has grown by four to five times. So life in general has become tougher for mortgage servicing companies. With a huge number of loans coming out of forbearance, it is going to get lot tougher for the servicers. As a servicer if your operations are not hyper-efficient, then you are really living on borrowed time.

But it is not just the servicers. We spoke to Eddy Perez, CEO of Equity Prime Mortgage. He said, loan production volume in 2020 is expected to be the 2nd highest after the 2008 crisis. That is not bad, right? But lenders are really jittery. That is because lenders added lot of cost to their operations to support the growth in 2020. That cost, if not dealt with quickly can be disastrous to most lenders. So you either get an outsourced partner that can really scale up and down or you bring in tech.

We also spoke to Alexander Alexander Rosenblum, CEO at Axia Home Loans. He spoke beautifully about how a people centric leadership empowered his teams & employees to align their personal ambitions with company goals. This is also reflected in how Axia Home Loans is structured - It is America's first 100% employee owned mortgage company. Don't miss this episode.

Have a great week ahead.

MBA Urges Federal Agencies to Clarify How AI Technologies Apply to Regs - MBA Newslink — newslink.mba.org

In the letter, MBA also describes AI’s benefits and uses in the mortgage space, especially in expanding credit, and offers suggestions for how the agencies can facilitate broader adoption of AI within the agencies’ regulatory framework

Lumber prices fall from 2021 peak, end June at five-month low | National Mortgage News — www.nationalmortgagenews.com

After lumber futures skyrocketed to an all-time high in mid-May, prices fell by more than half at the end of June.

HSBC and TSB have each slashed mortgage rates to 0.94% for some borrowers, but the eye-popping deals don’t make financial sense for everyone. Last mo...

According to a recent Zillow survey, fewer than a quarter of established homeowners refinanced their mortgages over the last year, even though about half of those who did say they cut their monthly payments by...

Mortgage financing has long been a staple of traditional banks, but in the United States, during the decade following the 2007-08 global financial crisis, many banks retreated from this once-lucrative business. What are some of the factors that have made servicing mortgages more onerous and less attractive to banks, and what can be done to rectify the situation—for the benefit of banks, mortgagors and mortgage market as a whole?

Mortgage Vault Podcast: How people centric leadership can be an edge in a hyper-competitive market: In conversation with Alexander Rosenblum on Apple Podcasts — podcasts.apple.com

Peter Drucker once famously said - "Culture eats strategy for breakfast." All successful leaders recognize that culture of your company always determines success regardless of how effective your strategy may be.

In this episode, Alexander Rosenblum, CEO at Axia Home Loans shares how a people centri…

Mortgage Vault Podcast: In conversation with Eddy Perez, CEO at EPM: On all things - leadership, racial equity in lending and surviving the pricing war. on Apple Podcasts — podcasts.apple.com

In this episode we are in conversation with Eddy Perez, Co-Founder & CEO at Equity Prime Mortgage. Eddy talks about his early years in the mortgage industry & how he pivoted from a being a broker partner to running a full suite mortgage lending company.

He also shares his playbook of building a bo…