Dear Friends, Colleagues & Customers:

Let us start this newsletter with some good news. Fannie Mae and Freddie Mac announced that they will be dropping the mortgage refinance fee, lowering costs for borrowers. They were charging lenders a 50 basis-point fee for all loans lenders delivered to the two mortgage giants, which was promptly passed on to the borrowers. The announcement means, lower refinance costs for borrowers. Expect a small jump in refinances.

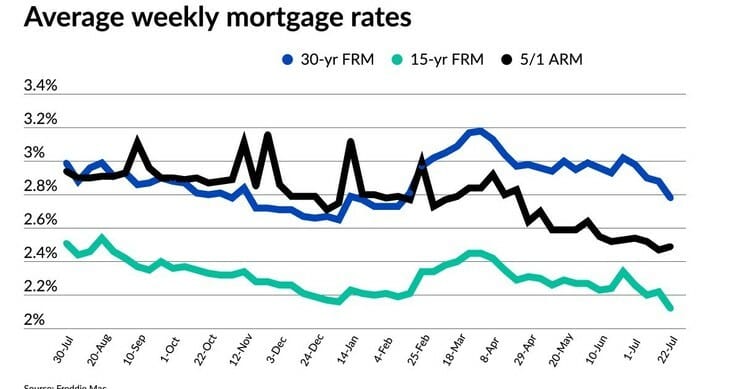

Just when we were thinking that the Covid saga is behind us, cases started increasing again. Many of the cases are attributed to the new Delta variant. This spooked the markets enough that there was a sell off in the stock market this Monday and bond rates and treasury rates fell along with it. Following the trend, the 30-year fixed-rate mortgage average dropped to 2.78 percent with an average 0.7 point. It was 2.88 percent a week ago and 3.01 percent a year ago. The 30-year fixed average has fallen four weeks in a row. Some more boost to the mortgage market.

Do any of you remember the news about IBM Watson computer beating the world champions in Jeopardy? There was lot of talk about the machines taking over the world (which thankfully hasn't happened) after that event. Not only that, the Watson technology was expected to turn the fortunes in its favour for IBM. But neither happened. New York Times published an interesting article about this. Apart from IBM's missteps, the reason boils down to this - Today's state of the art Artificial Intelligence (AI) is still what they call Narrow AI i.e. AI built for specific purpose or specific task. We are no where near General AI, which is AI that can learn any human-like task. This is also the reason why, while our software Vaultedge Mortgage Automation can understand very complex mortgage documents, it can not decipher the meaning of simple children's books :). Lesson to you - when you pick your AI solution just evaluate how well it can perform for the specific task at hand.

Rising lumber prices have been a huge challenge on the supply side of the housing market. The price of two-by-four lumber hit an all time high of $1670 in May 2021, which was 6 times the price a year before that. Thankfully, lumber prices have fallen steadily over the last few weeks and reached $521 this week. However it will be some time before the benefit of lower costs be passed on to home buyers. For now expect new home prices to remain high.

Regular readers of this newsletter know about the weekly Vaultedge podcast. We had some fantastic guests in the last two weeks. Earlier this week, we spoke to Kevin Peranio, Chief Lending Officer of Primary Residential Mortgage Group (PRMG). Kevin discussed how technology can be used to improve the lending experience for two major borrower demographics - racial minorities and millennials. Kevin also shared his framework of choosing & deploying a technology stack that provides an order of magnitude efficiency across the loan origination life-cycle. This is a must listen for everyone who is looking at leveraging tech to improve their business.

We also spoke to Eddy Perez, Co-Founder & CEO at Equity Prime Mortgage. Eddy talks about his early years in the mortgage industry & how he pivoted from a being a broker partner to running a full suite mortgage lending company. He also shared his views on improving racial equity in homeownership, on driving policy initiatives as the co-chair at IMB Executive Council at MBA and on dealing with the risk of pricing war in current market conditions. An insights-packed episode. Do check out.

Earlier this week, something interesting caught my eye. Officials from the hill state of Arunachal Pradesh in India trekked 9 hours to vaccinate 16 grazers (shepherds). Isn't that amazing! Governments world over are moving heaven and earth to vaccinate their populations. But unfortunately vaccine hesitancy is playing spoilsport. If you are one of those that haven't gotten a shot, please do yourself a favour and get the shot. I will buy you a beer when we meet next time :)

Have a great weekend. Cheers!

Fannie and Freddie drop mortgage refinance fee, lowering costs for borrowers — www-cnbc-com.cdn.ampproject.org

Fannie and Freddie are dropping a fee on mortgage refinances that was instituted during the pandemic, according to the Federal Housing Finance Agency. They were charging lenders a 50 basis-point fee for all loans they delivered to the two mortgage giants, which was designed to cover losses projected as a result of the pandemic.

Mortgage rate falls 10 pts following COVID-19 worries, FHFA news | National Mortgage News — www.nationalmortgagenews.com

A rise in coronavirus cases and the removal of a 50-basis-point adverse market fee designed to protect Fannie Mae and Freddie Mac during the pandemic contributed to the largest weekly drop so far this year.

Fixed mortgage rates are back down to February lows after sharp decline in bond yields and removal of unpopular refinance fee — www.washingtonpost.com

The 30-year fixed-rate average fell for the fourth week in a row and is now down to 2.78 percent.

Freddie Mac boosts its 2021 mortgage origination forecast | National Mortgage News — www.nationalmortgagenews.com

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

IBM’s artificial intelligence was supposed to transform industries and generate riches for the company. Neither has panned out. Now, IBM has settled on a humbler vision for Watson.

What federal policy changes mean for mortgage servicing in H2 2021 | National Mortgage News — www.nationalmortgagenews.com

Those handling loan modifications anticipate a growing secondary market for loans in forbearance as they budget cautiously for additional alterations of regulations down the road.

Prices for two-by-fours surged in May to more than twice their previous record, set three years ago when there were about 15% fewer homes being built. But wood prices have since plunged.

Mortgage Vault Podcast: How to deploy a technology stack for a better, faster & cheaper lending experience: In conversation with Kevin Peranio, Chief Lending Officer at PRMG — podcasts.apple.com

Kevin talks about his plans to grow PRMG to $1 billion a month in loan volume and the role of technology in it.

HousingWire's Digital Media Manager Alcynna Lloyd joins Courtney Graham and Bill Dallas as they share the latest updates on the housing market and how they're winning in a red-hot purchase market.

Mortgage Vault Podcast: In conversation with Eddy Perez, CEO at Equity Prime Mortgage: On all things - leadership, racial equity in lending and surviving the pricing war — podcasts.apple.com

Eddy talks about his early years in the mortgage industry & how he pivoted from a being a broker partner to running a full suite mortgage lending company.

Tawang Deputy Commissioner leads team to inoculate villagers of Luguthang at 14,000 ft