Intercontinental Exchange (ICE), the company that bought Ellie Mae and rechristened it to ICE Mortgage Technology is all set to acquire Black Knight for $13.1 billion. The purchase still needs consent from Black Knight stockholders and government regulators. The acquisition is targeted for completion by the first half of 2023. This is a marriage of two of the leading giants of the mortgage industry. It probably would be good for the two companies involved. Would it be good for the industry? Well, that is an open question. It depends on whether ICE will put its resources to truly improve its technology products, which are lagging behind in the user experience curve or will it just flex its muscle harder to lock in customers. Either way, the future will be interesting. Encompass, an LOS solution owned by ICE, is one of the mortgage solution leaders that helps lenders track loan applications, manage compliance and optimize risks. Vaultedge is an official Encompass integration partner. With the acquisition, hopefully it will make it easier for us at Vaultedge to extend our integrations to Black Knight's MSP and Empower.

______________________________________________

Diversity is such an important aspect for any industry. I feel diversity and inclusion bring in new ideas, experiences, best practices that frankly can benefit all. The mortgage industry has been a pioneer in inclusivity and diversity. And keeping that objective in mind, the FHFA announced that Fannie Mae and Freddie Mac (the Enterprises) will require lenders to use the Supplemental Consumer Information Form (SCIF) as part of the application process for loans that will be sold to the Enterprises. The purpose of the SCIF is to collect information about the borrower's language preference, if any, and on any homebuyer education or housing counseling the borrower received, so lenders can better understand borrower needs during the home buying process.

______________________________________________

For the past few weeks, we have been talking about rising interest rates and how it has become a wet blanket for every homeowner’s dream. House gross sales in March have been 12.6% decrease than final 12 months. Inflation has been a bane. As collateral damage, it has affected the purchase rates and drying up the refinancing exercise as well. The last week in April saw a 2.5% rise in home purchase loan application from the prior week. However this was 50% decrease in contrast with 12 months earlier.

______________________________________________

Vaultedge is getting ready to attend the MBA's Secondary & Capital Markets Conference & Expo, in NYC. This event is designed for single family real estate finance professionals in the secondary and capital markets space. And we would love to participate in workgroups, committee meetings to know, learn, share from the industry's best. Hope to see some of you there!

Happy reading!

Intercontinental Exchange buying Black Knight for $13.1B | National Mortgage News — www.nationalmortgagenews.com

But the deal could be derailed by antitrust concerns given the size of both companies in the mortgage technology field.

As a result of rising mortgage rates and a more aggressive strategy from the Fed, buyers continued to flock to the housing market during the early months of

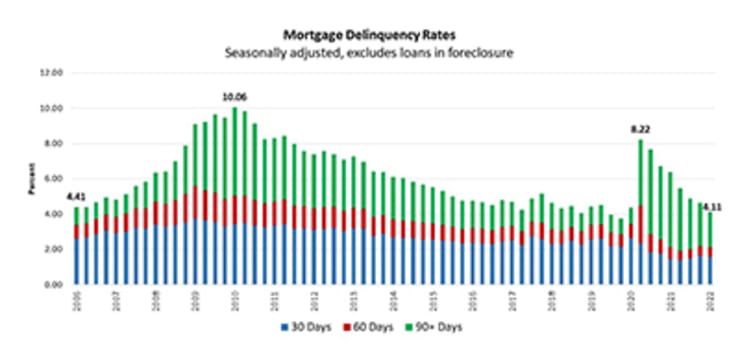

The delinquency rate decreased 54 basis points from the fourth quarter of 2021 and was down 227 basis points from one year ago.

FHFA says lenders must use form indicating preferred language | National Mortgage News — www.nationalmortgagenews.com

However originators selling loans to Fannie Mae and Freddie Mac will have almost 10 months before the Supplemental Consumer Information is required.