On one hand, lenders are reeling under low production volumes due to high interest rates. On the other hand, secondary market is thriving with robust deal activities - as banks & non banks sell off large chunk of their MSR portfolio.

Nearly $12Bn of bulk MSR offerings, are up for bids. Interestingly, Ginnie Mae MSRs form a significant chunk of this loan pool.

The question is, what's driving this trend ? Are we witnessing an exodus from Ginnie Mae MSRs?

While a high interest rate environment is causing MSR valuation to go up, Ginnie Mae portfolio pose a conundrum.

Firstly, vast majority of these MSRs are produced & serviced by small non-banks. As of September end, non bank lenders had a portfolio of $1.77 trillion Ginnie Mae MSRs.

This confounds non-banks with a unique challenge.

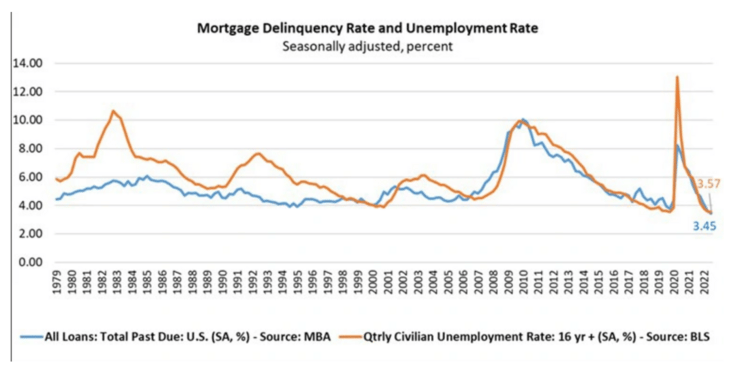

As holders of Ginnie Mae MSRs, they are responsible for assuring that timely payments are made to bondholders. Even when the underlying loans go unpaid due to delinquencies, those servicers still must cover bondholders' payments. Given the forecast of high interest rates & unemployment trends in 2023, MBA predicts delinquencies & defaults to only go up in the coming months.

This puts huge payment risks on non-banks.

Furthermore, Ginnie Mae's new capital regulation mandates MSR holders to maintain a risk weighted capital adequacy by end of 2023. This is going to push up operational costs & regulatory burden for non-banks, who are already struggling under pressures of low production volume.

For now, non-banks are hedging their risks by rationalizing their MSR portfolio & selling part of their Ginnie Mae assets.

Going forward, it would be interesting to watch - on how non bank lenders with Ginnie Mae heavy portfolio, navigate a high delinquency & capital intensive market environment in 2023.

Will Ginnie MSR portfolios prove to be a 'weak link' for non-bank balance sheets in 2023 ?

Weekly Roundup

With successive bumps to mortgage interest rates, the value of MSR portfolio have gone up. This is because loan-prepayment speeds for lower-rate loans have dropped on account of non-existent refi opportunity. Consequently, these loans are expected to pay out over a longer period - jacking up MSR value.

Riding the wave, three advisory firms, active in the MSR market, recently unveiled mortgage-servicing offerings for loan portfolios valued in total at $12B. The new offerings are a sign that MSR trading continues to be healthy.

What's interesting is, how prospective MSR buyers plan to navigate uncertainties around Ginnie Mae MSRs in 2023 with risk of delinquencies and risk weighted capital norms kicking in..

The MSR sector continues to shine, but there is a looming concern of GNMA MSRs — www.housingwire.com

Mortgage advisory firms Prestwick Mortgage Group and partner Mortgage Capital Trading (MCT); Incenter Mortgage Advisors; and MIAC Analytics are out with a total of 10 bulk mortgage-servicing rights (MSR) offerings. The question is what's driving this uptick in MSR transactions.

A report by Recursion shows that over the first nine months of 2022, banks have been net buyers of Fannie Mae and Freddie Mac MSRs and net sellers of Ginnie Mae MSRs.

In stark contrast to banks, nonbanks had a legacy portfolio of $1.77 trillion Ginnie Mae MSRs as of the end of September. That’s more than five times the size of the banks’ aggregate Ginnie MSR portfolio of $334 billion as of the same date. Those Ginnie MSRs, however, represent a weak link in the nation’s housing system when the economy is under stress, as it is now.. Read More

Ginnie Mae on Friday announced it has extended the mandatory implementation date of its risk-based capital requirement for nonbanks to 2024. The rule — which reduced the minimum risk-based capital ratio from 10% to 6%, but put a 250% risk weight on the MSR asset and the dollar-for-dollar deduction from capital for excess MSRs — was set to go into effect at the end of 2023... Read More

The Mortgage Bankers Association on Thursday released its 3rd Quarter National Delinquency Survey, reporting delinquency rate for mortgage loans on one-to-four-unit residential properties fell to its lowest level since the Survey’s inception. However, with rising interest rates & anticipated uptick in unemployment rates in 2023, delinquency is expected to pick up again.

“The delinquency rate will likely increase in upcoming quarters from its current record low because of both the anticipated uptick in unemployment and the effect of natural disasters such as Hurricane Ian in Florida, South Carolina, and other states, which will likely result in an increase in forbearance agreements to allow impacted homeowners to get back on their feet,” Walsh said... Read More

Spotlight: What's new at Vaultedge

While MSR market is abuzz with deal activities, we are also keeping a watch on potential increase in delinquencies & defaults in 2023. To help us better understand the outlook for default servicing in the upcoming year - we spoke to Michael Merritt on this week's episode of Mortgage Vault Podcast.

Mike is Senior Vice President, Customer Care and Default Mortgage Servicing at BOK Financial. He's an expert in default servicing with 10+ years of experience across Mr. Cooper, Goldman Sachs & BOK Financial.

Mike talks about the current "high interest rate" macro environment, how it's expected to shape default rates in 2023 and what servicers can do, to prepare for it.

He also shares how artificial intelligence & ML is critical to keep loan files clean & well indexed. This helps customer agents retrieve the right data in the first instance and provide a smooth servicing experience even during a default surge.

Listen to the full episode below

A playbook for default servicing excellence in high interest environment: Michael Merritt, BOK Financial — www.vaultedge.com