"What goes up, must come down." - Isaac Newton.

Law of gravity seems to be unfolding for housing prices as we move into 2023.

Major housing markets like Los Angeles, Phoenix & San Diego reported an 8% median fall in prices, whereas San Jose & San Francisco experienced as much as 13% dip.

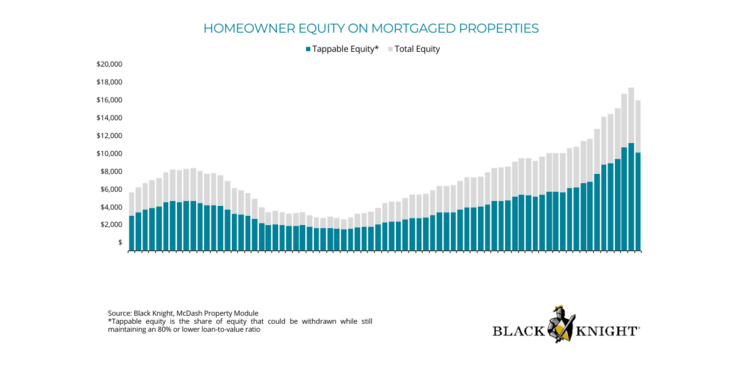

The fallout - mortgage borrowers lost a record amount of equity in 2023. According to Black Knight, home owners lost $1.3 trillion or 7.6% of their equity during 3Q alone.

This has led to a spike in underwater mortgages - with 2022 originations making up 60% of underwater mortgages. However, as per, Ben Graboske, president of Black Knight Data & Analytics, there is little to worry as of now.

Although the number of underwater homeowners has climbed nearly 275,000 over the past four months, fewer than 500,000 homes are currently underwater nationwide. Nationally, 3.6% of borrowers are either underwater or have less than 10% equity, roughly half the pre-pandemic share; a historically and extremely low share (0.84%) are in negative equity positions.

However, what is alarming is the rapid pace at which home equity has eroded in a span of just few months. With the prediction of negative growth in housing prices in coming months, we can expect a further erosion of home owner equity going into 2023.

Will there be a rise in underwater mortgages ?

If so, then it could have a dampening effect on demand for HELOC products or new originations despite fall in mortgage rates. All the more reason that originators, mainly IMBs, must look out for early warning signs and prepare to extend their runway beyond 2023.

Weekly Roundup

Redfin published its latest annual housing outlook report that peeks at 6 predictions likely to pan out for the housing market in 2023. Despite some short term fall in mortgage rates & softening of housing prices, overall recovery of production volumes will remain subdued for most part of 2023. However, the second half of 2023 should turn the table for the housing market.

A key prediction is that home values will post a 4% yearly drop for the first time since 2012, settling at $368,000. Question is, what will be the impact on foreclosures ? Will it lead a rise in underwater mortgages ?

Annual home price movements could move into negative territory by next spring, but then turn around and post year-over-year growth of 4.1% through October 2023, the latest CoreLogic Home Price Index report found. The CoreLogic HPI is a different metric than the S&P CoreLogic Case-Shiller index, which measures prices in 20 large cities; this fell 1.2% in September compared with August.

"Home price growth continued to approach single digits in October, and it will move in that direction for the rest of the year and into 2023," said Selma Happ, interim lead of the Office of the Chief Economist at CoreLogic. Read More

According to Black Knight’s latest Mortgage Monitor Report, homeowner equity saw record levels of contraction in the third quarter of 2022, after peaking in the second quarter of this year. Equity among mortgaged homes is now nearly $1.5 trillion, or -8.4%, off its May 2022 peak, with the equity of the average borrower down $30,000 from earlier this year.

However, there is a silver lining. The equity positions remain strong, at 46% above pre-pandemic levels, with the average mortgage-holder having more than $92,000 more equity than before. The only catch being the number of underwater borrowers more than doubled due to this equity pullback. Read More

One in 12 purchase mortgages originated in 2022 is now underwater, as the downturn in home prices over the past few months has opened the door to a slowly emerging but potentially problematic issue, Black Knight found.

Of the 450,000 mortgages where the amount owed exceeded the value of the home at the end of the third quarter, almost 60% were originated this year, with purchases accounting for 95% of those. The percentage reflects a total of more than 250,000 underwater borrowers, while close to another million now have less than 10% equity in their properties, the report said.

Of all homes purchased with a mortgage in 2022, 8% are now at least marginally underwater and nearly 40% have less than 10% equity stakes in their home, a situation most concentrated among FHA/VA loans. More than 25% of FHA/VA loan purchases have dipped into negative equity, with 80% having less than 10% equity. Read More